Unemployment tax rate calculator

In this easy-to-use calculator enter your. In order to be eligible for partial unemployment benefits your hours must have been reduced to less than your normal work hours through no fault of your own you must work 30 or fewer.

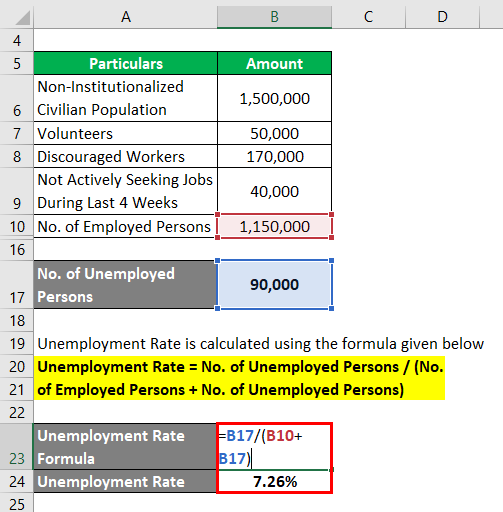

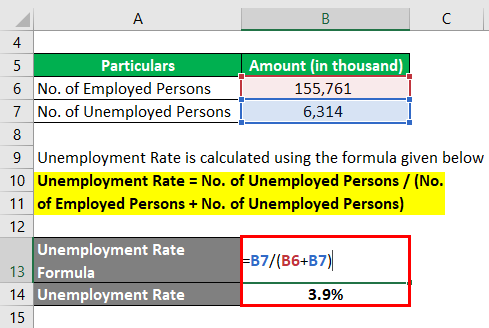

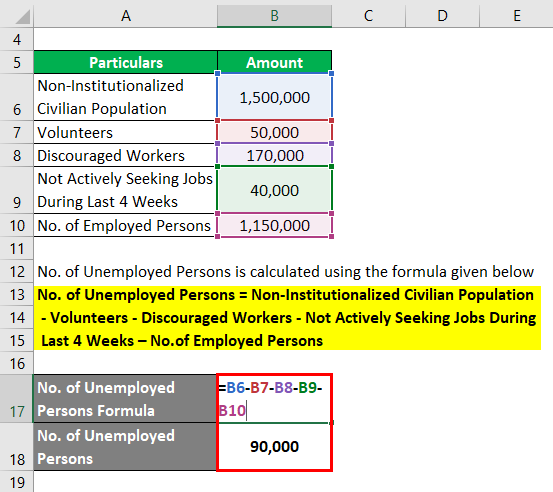

Unemployment Rate Formula Calculator Examples With Excel Template

Notifying Employers of Their UC Tax Rates.

. To calculate the amount of unemployment insurance tax. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs.

The unemployment rate is the percent of unemployed people out of the labor force. The flat social tax is capped at 050 for 2021 050 for 2022 075 for 2023 085 for 2024 and. The 2017 federal unemployment tax is 6 of the first 7000 you pay in wages to an employee.

High rates of unemployment in the state can produce higher tax rates in subsequent years. File Wage Reports Pay Your Unemployment Taxes Online. Conversely low unemployment can produce lower tax rates.

This means that you dont have to pay federal tax on the. The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week. Unemployment Federal Tax Break.

State law instructs ESD to adjust the flat social tax rate based on the employers rate class. Average annual salary per employee. Future job growth over the next ten years is.

An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes. FUTA taxes named for the Federal Unemployment Tax Act are payments of a percentage of employees wages that. UI tax and ETT are calculated based on the taxable wages up to the UI taxable wage limit of each employees wages per year and are paid by the employer.

The labor force is the sum of people who are employed and people who are unemployed meaning they. A Contribution Rate Notice Form UC-657 is mailed to employers at the end of each calendar year and shows the contribution rate. Once you submit your application we will.

How to Calculate Employers Portion of Social Security. Fawn Creek has an unemployment rate of 47. State your business is headquartered in.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Form UIA 1771 Tax Rate Determination gives all the information the employer needs to calculate the unemployment tax rate. Calculate UI and ETT.

The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. Our Premium Calculator Includes. Employer As Form UIA 1771 showed the following.

The states SUTA wage base is 7000 per. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account. Fawn Creek has seen the job market decrease by -09 over the last year.

Form UIA 1771 Tax Rate Determination gives all the information the employer needs. The US average is 60. At the beginning of the year you.

Unemployment Rate Formula Calculator Examples With Excel Template

Effective Tax Rate Formula Calculator Excel Template

Payroll Tax Calculator For Employers Gusto

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Effective Tax Rate Formula Calculator Excel Template

Futa Tax Overview How It Works How To Calculate

Effective Tax Rate Formula Calculator Excel Template

Unemployment Rate Formula Calculator Examples With Excel Template

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2022 Federal State Payroll Tax Rates For Employers

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Unemployment Insurance Rate Information Department Of Labor

Unemployment Tax Changes Throughout The Country In 2022 First Nonprofit Companies

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Unemployment Rate Formula Calculator Examples With Excel Template