49+ mortgage interest deduction limitation worksheet

Web Home mortgage interest limited If your home mortgage interest deduction is limited only enter on line 10 the deductible mortgage interest and points. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Kaiserslautern American March 8 2019 By Advantipro Gmbh Issuu

Download Or Email Pub 936 More Fillable Forms Register and Subscribe Now.

. Web Before the TCJA the mortgage interest deduction limit was on loans up to 1 million. Web The key is that all of your mortgage interest is included with your tax return if your outstanding principal loan balance is below the maximum of 750000 or 1M for. Since the limit for a pre 2017.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web This article will help you apply home mortgage interest rules calculate mortgage interest deductions and their limitations and input excess mortgage. Web Forms and Instructions About Publication 936 Home Mortgage Interest Deduction About Publication 936 Home Mortgage Interest Deduction Publication 936.

0 signatures 0 check-boxes 16 other fields Country of origin. Your clients want to buy a house with a. Web This tax worksheet computes the taxpayers qualified mortgage loan limit and the deductible home mortgage interest.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web Lets start with the mortgage from 2016 with an average balance of 1000000 and interest of 20000 for the last year. If the taxpayers mortgage interest deduction must be limited due to the amount or nature of the loans enter the mortgage information in.

Homeowners who bought houses before December 16. Web The Mortgage Deduction Limit Worksheet form is 1 page long and contains. Now the loan limit is 750000.

Web Home Mortgage Interest Limitations. Web The business portion of your home mortgage interest allowed as a deduction this year will be included in the business use of the home deduction you report on Schedule C Form. That means for the 2022 tax year married.

Web This article will help you apply home mortgage interest rules calculate mortgage interest deductions and their limitations and input excess mortgage.

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

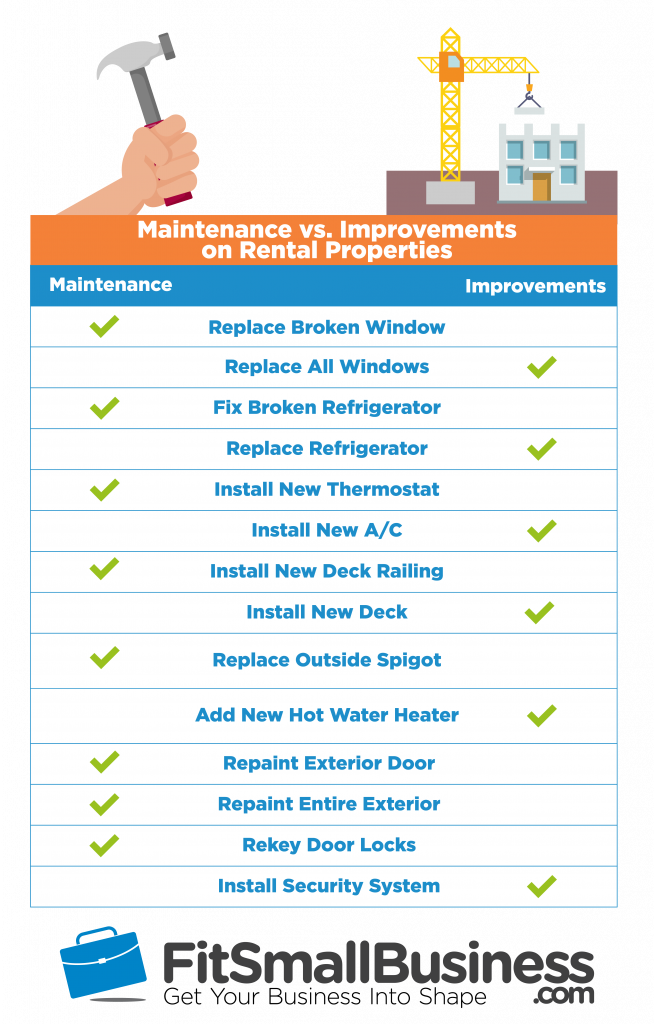

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

Mortgage Interest Deduction How It Calculate Tax Savings

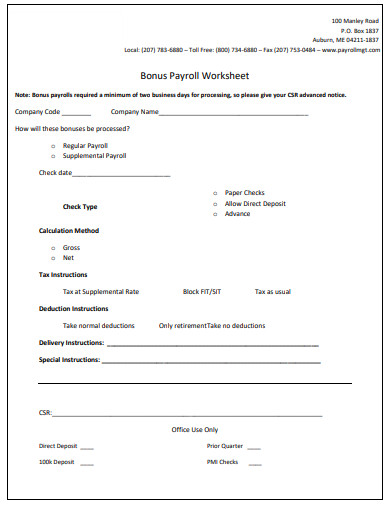

Payroll Worksheet 10 Examples Format Pdf Examples

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Rev Proc 2013 13 A New Option For The Home Office Deduction

The New Home Mortgage Interest Deduction Mark J Kohler

Five Types Of Interest Expense Three Sets Of New Rules

Mortgage Interest Deduction A Guide Rocket Mortgage

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Tax Deduction What You Need To Know

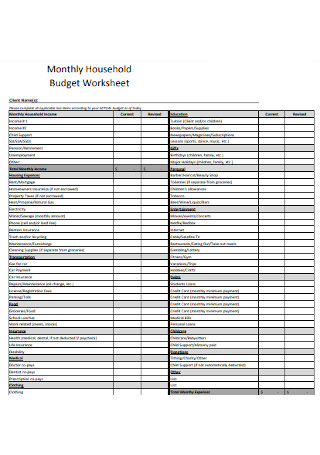

49 Sample Monthly Budgets In Pdf Ms Word

Mortgage Interest Deduction Changes In 2018

49 Sample Monthly Budgets In Pdf Ms Word